Congratulations on taking the leap into homeownership! While you've likely calculated your monthly mortgage payment down to the penny, the reality is that your housing expenses are just getting started. First-time buyers often discover that the true cost of homeownership extends far beyond their mortgage, taxes, and insurance.

Understanding these hidden expenses upfront can mean the difference between financial confidence and house-poor stress. Let's explore the costs that catch most new homeowners by surprise—and how to budget for them effectively.

The Reality Check: True Cost of Homeownership

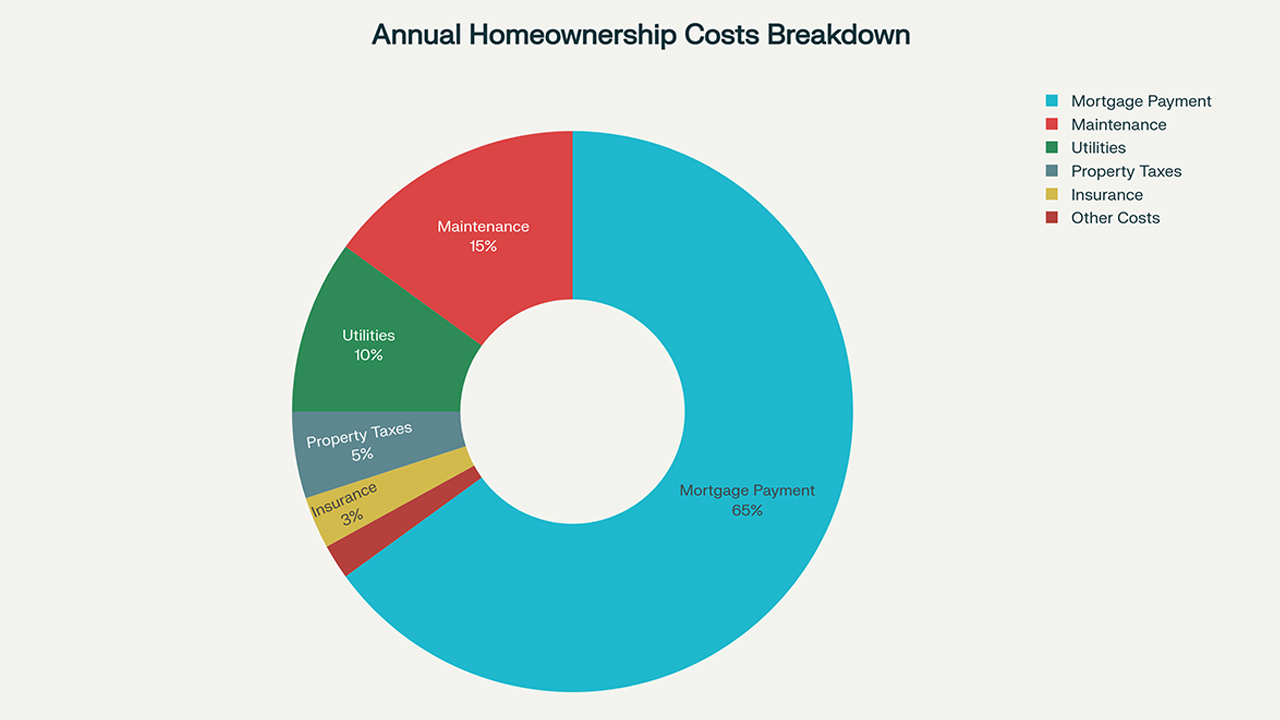

Financial experts recommend budgeting an additional 1-4% of your home's value annually for maintenance and unexpected expenses alone. On a $350,000 home, that's $3,500 to $14,000 per year—or $290 to $1,170 per month on top of your mortgage payment.

Annual homeownership costs breakdown: mortgage vs. hidden expenses

Annual homeownership costs breakdown: mortgage vs. hidden expenses

The Big-Ticket Surprises

1. Major System Replacements

Your home inspection might show everything working, but major systems have limited lifespans that don't always align with your budget timeline.

| System | Average Lifespan | Replacement Cost |

|---|---|---|

| HVAC System | 15-20 years | $5,000 - $12,000 |

| Water Heater | 8-12 years | $1,200 - $3,500 |

| Roof | 20-30 years | $8,000 - $25,000 |

| Windows | 20-25 years | $300 - $800 per window |

2. Appliance Failures and Replacements

Even if appliances are included with your home, they don't come with guarantees. When your refrigerator dies on a Sunday night or your washer floods the laundry room, you'll need immediate solutions.

The Monthly Hidden Expenses

3. Utility Shock

Moving from a small apartment to a whole house often means dramatically higher utility bills. Many first-time buyers underestimate the cost of heating, cooling, and powering a larger space.

- Electricity: Can double or triple from apartment living

- Gas: Heating a whole house vs. shared building costs

- Water/Sewer: No longer included in rent

- Trash/Recycling: Municipal fees you've never seen before

- Internet/Cable: Installation fees and higher-tier plans for larger homes

4. Yard and Exterior Maintenance

That beautiful lawn doesn't maintain itself. Exterior upkeep includes ongoing costs that renters never consider.

- Lawn equipment (mower, trimmer, leaf blower): $500-$2,000 initial investment

- Seasonal plantings and garden maintenance

- Tree trimming and removal

- Snow removal equipment or services

- Pest control for outdoor spaces

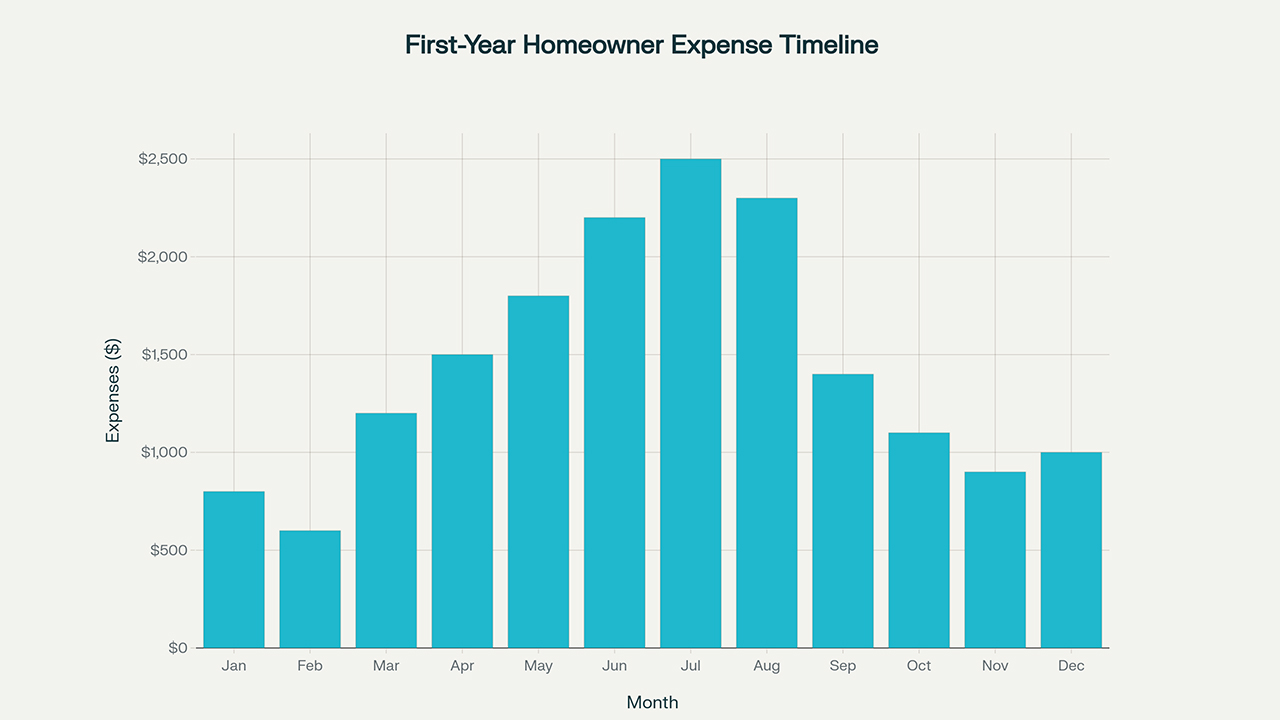

First-year homeowner expense timeline showing seasonal cost spikes and patterns

First-year homeowner expense timeline showing seasonal cost spikes and patterns

The Sneaky Ongoing Costs

5. Home Security and Safety Updates

Protecting your investment—and your family—often requires upgrades that weren't obvious during the buying process.

- Security system installation and monthly monitoring

- Smoke detector and carbon monoxide detector replacements

- Locks re-keying or replacement

- Fence repairs or installation for privacy/security

6. HOA Fees and Special Assessments

If you bought in a community with an HOA, the monthly fees are just the beginning. Special assessments for major community improvements can arrive with little warning.

7. Property Tax Increases

Your property taxes aren't fixed. As your home's value increases or local tax rates change, your annual tax bill can climb significantly.

The "Move-In" Money Drain

8. Furnishing and Decorating a Larger Space

Your apartment furniture might look lost in your new house. The urge to fill empty rooms can quickly drain your savings.

- Window treatments for every room

- Additional furniture for larger spaces

- Lighting fixtures and ceiling fans

- Garage storage and organization systems

9. Professional Services You Never Needed Before

As a homeowner, you'll encounter service needs that apartment living never required.

- Gutter cleaning: $100-$250 twice yearly

- HVAC maintenance: $150-$300 annually

- Chimney cleaning and inspection: $200-$400 annually

- Septic pumping: $300-$600 every 3-5 years

- Well water testing: $100-$300 annually