How a September Fed Rate Cut Could Revive the Home-Buying Market

How a September Fed Rate Cut Could Revive the Home-Buying Market

The U.S. housing market has faced serious affordability challenges in recent years. High mortgage rates, limited inventory, and stubbornly rising home prices have left many buyers on the sidelines. But with the Federal Reserve expected to cut interest rates in September 2025, the tide may be turning. A rate cut could help bring fresh momentum to the market, giving both buyers and sellers new reasons to act.

Why a Fed Rate Cut Matters

The Federal Reserve’s benchmark interest rate influences borrowing costs across the economy, including mortgages. While mortgage rates don’t instantly mirror Fed decisions, they tend to follow the same direction over time. Even a small reduction can reshape affordability.

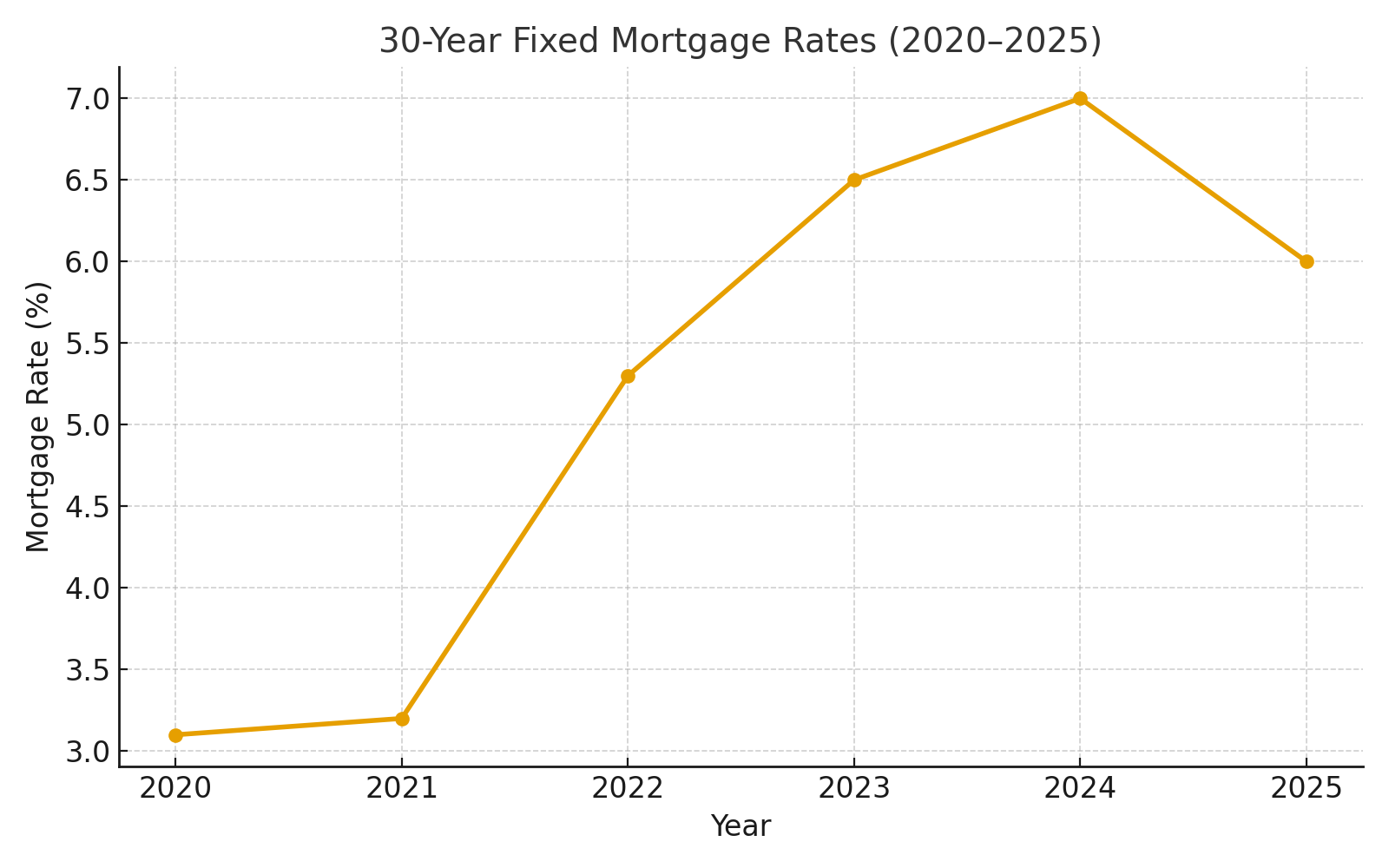

Mortgage Rate Trend (2020–2025)

A half-point drop could save homeowners hundreds of dollars per month, depending on the loan size [1].

What It Means for Home Buyers

For aspiring homeowners, lower borrowing costs can be life-changing:

-

Smaller monthly payments: Reduced rates mean more manageable expenses.

-

Greater buying power: Buyers may qualify for larger loans without stretching budgets.

-

Renewed confidence: Many who paused their search may re-enter the market.

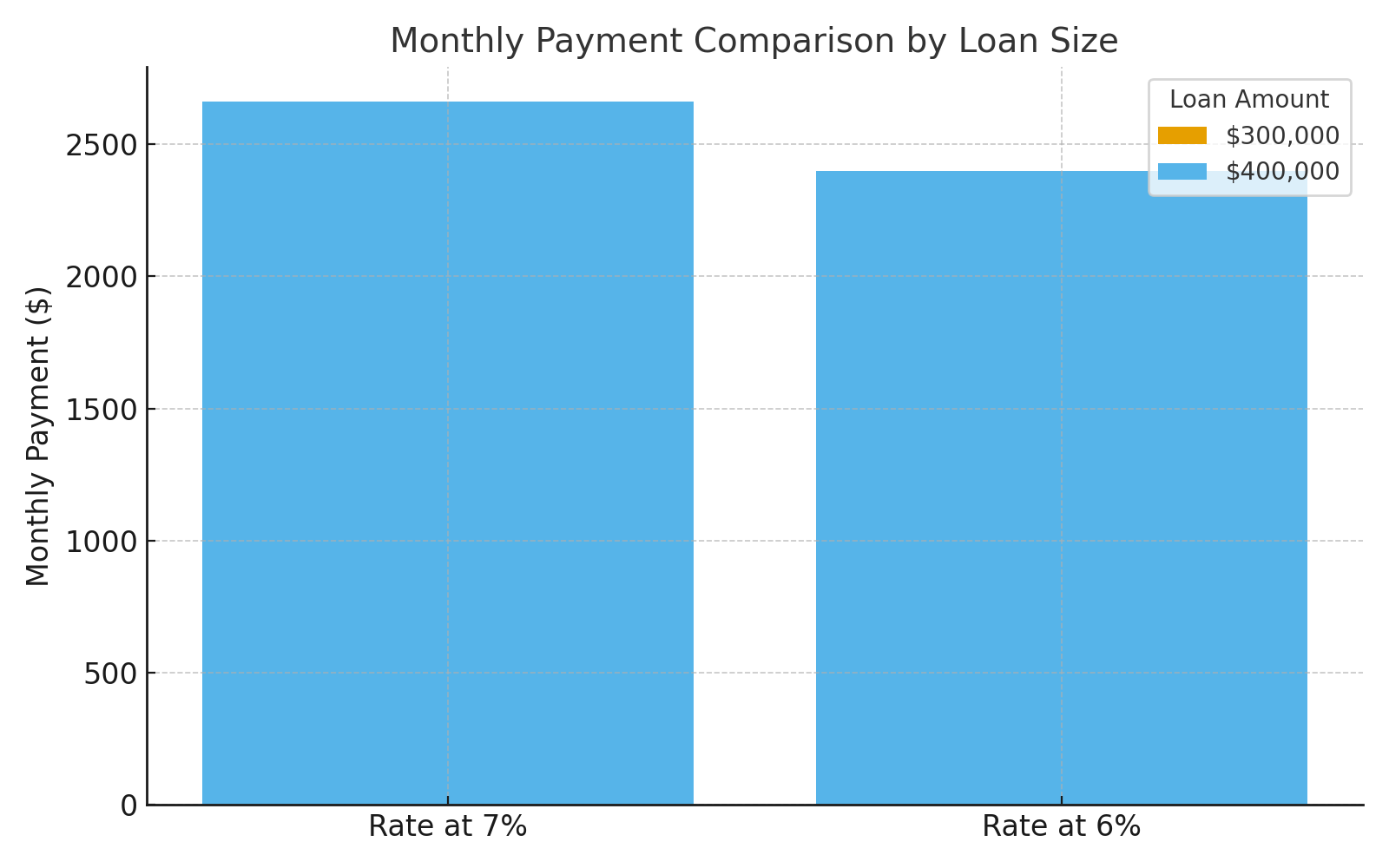

Monthly Payment Comparison

For first-time buyers especially, these savings could mean the difference between renting and owning.

Impact on Sellers and Inventory

Sellers may see benefits too:

-

Faster sales as more buyers re-enter the market.

-

Stabilizing or rising prices in certain regions.

-

Unlocking inventory as the “lock-in effect” fades—where homeowners held onto low-rate mortgages instead of selling.

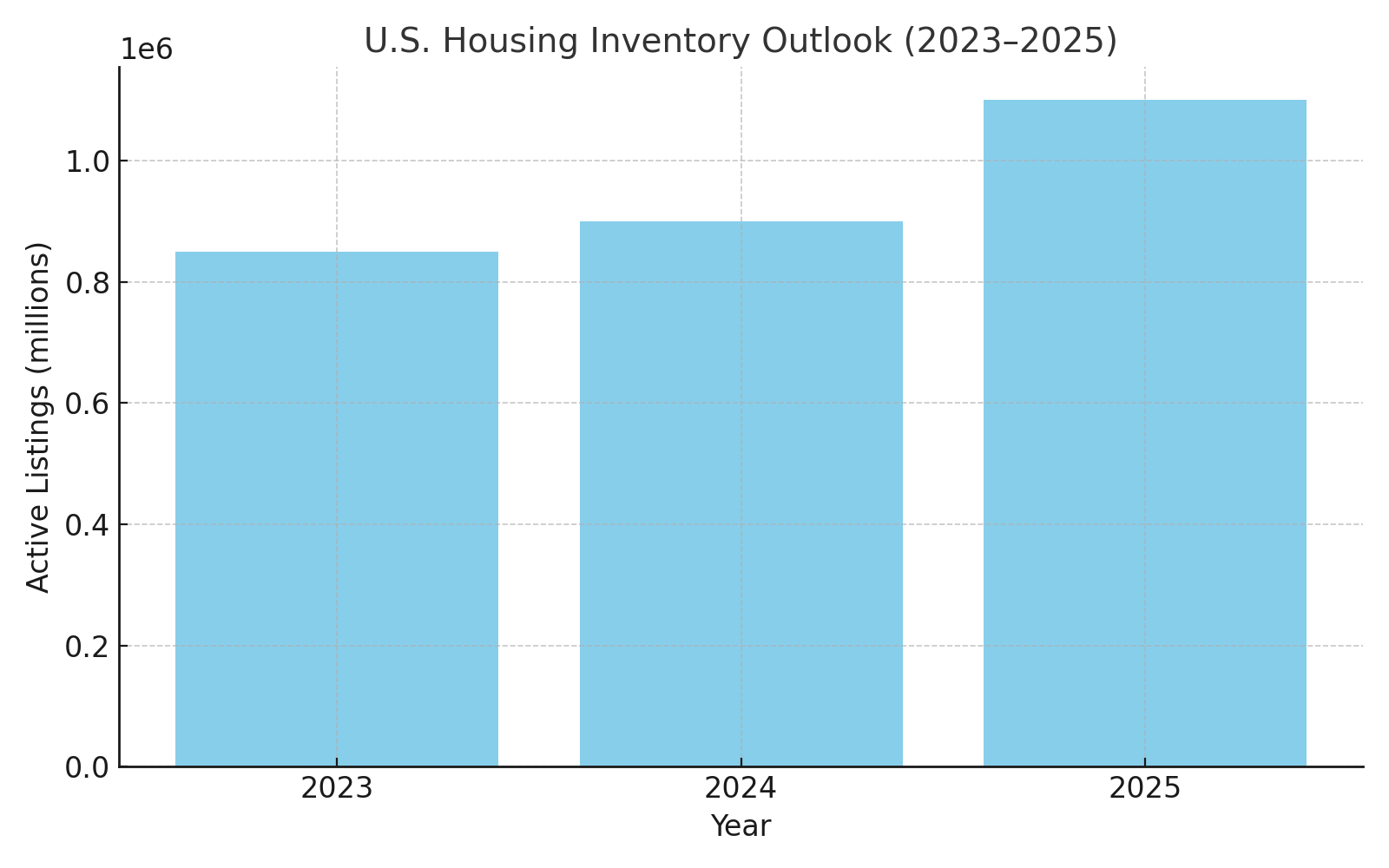

Housing Inventory Outlook

More listings would bring much-needed balance to the market, helping ease upward pressure on prices.

The Bigger Picture

A single rate cut won’t fix affordability overnight. Home prices remain elevated, and the supply of homes is still too tight. However, if the September decision marks the beginning of a steady easing cycle, it could:

-

Spark new demand.

-

Encourage more listings.

-

Strengthen overall market confidence.

Risks remain. If inflation sticks around or the labor market weakens, the Fed may slow its pace. Still, many analysts see a September cut as the long-awaited turning point for U.S. housing [2][3].

Key Takeaway

A September Fed rate cut could breathe new life into the home-buying market. Lower payments, improved affordability, and greater buyer confidence may finally help bridge the gap between supply and demand.

For buyers, it may be the time to revisit your home search. For sellers, it could be the right moment to list. Either way, the housing market is gearing up for change.

References

[1] Federal Reserve Board. How Does Monetary Policy Influence Inflation and Employment? Retrieved from: https://www.federalreserve.gov/monetarypolicy/

[2] Norada Real Estate Investments (2025, Sept). Jerome Powell and the Federal Reserve: 80% Chance of Interest Rate Cut in September 2025. Retrieved from: https://www.noradarealestate.com/blog/jerome-powell-and-federal-reserve-80-chance-of-interest-rate-cut-in-september-2025/

[3] Investopedia (2025, Sept). Housing Costs May Reach 'Normal' Affordability by 2030: What Changing Prices and Rates Could Mean for You. Retrieved from: https://www.investopedia.com/how-changing-home-prices-and-mortgage-rates-could-bring-housing-costs-back-to-normal-affordability-levels-by-2030-11803561